The stock market is the ultimate equalizer. People who have billions of dollars somehow make poor decisions and lose it all with a few mouse clicks, while some 16-year-old kid has a higher return on investment on a picture of a monkey than with my own increasingly diversified portfolio. Frankly I’m sick or people to tell me to diversify –I wish the stock market was as easy as the 1970s – the most diversification investors probably had was land, gold, and probably some cows. Now I have to buy 10 Ether just to have the opportunity to bid on a JPEG of obscure farm animals.

NFTs aside, I’m tired of investing in blue chip tech companies trading with the volatility of a nuclear missile. Companies like Amazon, Apple, Facebook, now have crypto-like movements that makes even the safest of stocks feel like an afternoon in Vegas. The level of fear that people have with respect to the market is at Threat Level Midnight. Investors might as well flip a coin and hope tails never fails just to make stock market decisions on direction of certain stocks. Even S-Tier tech CEOs don’t know what’s happening in their own companies either. Meta CEO and Likely-Ex Machina stunt double Mark Zuckerberg literally cried in his office after dismal earnings call this week, in what was likely the singular outpouring of emotion ever displayed by him.

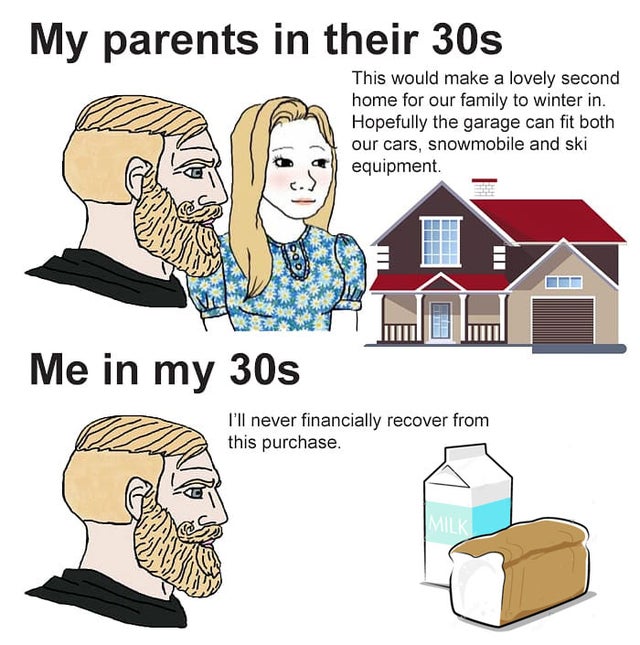

The government should probably step in and fix this debacle, right? WRONG! There’s a no holds barred approach to how much money one can simply YOLO into the markets akin to following others to jumping off a cliff. The government is like ‘we’re going to raise interest rates’ – but are they really? All the old heads around the country probably want to horde their old money and real estate like Scrooge McDuck with a financial advisor, leaving us young people still trapped in our parent’s basements complaining that we still can’t afford a house. One of the easiest stepping stones to adulthood is gatekept by boomers, seriously limiting what young people can invest in especially considering that the stock market is full of memes of people that lose life savings on the daily and don’t even bat an eye over it.

Have we become desensitized to loss porn? Does all of America actually have a gambling problem? Advocates say that personal finance should be taught for school age children, but with the rule of finance being constantly rewritten, should we just become part of this collective trial by fire just to get a leash on our own personal savings? The randomness equivalent of throwing ideas at a wall is now top tier financial advice given by both day-1 traders and the federal government.

Leave a comment